• Full frontier declarations will be required from 1 January 2022

• UK Roll on-Roll off ports will operate the Goods Vehicle Movement Service (GVMS) system

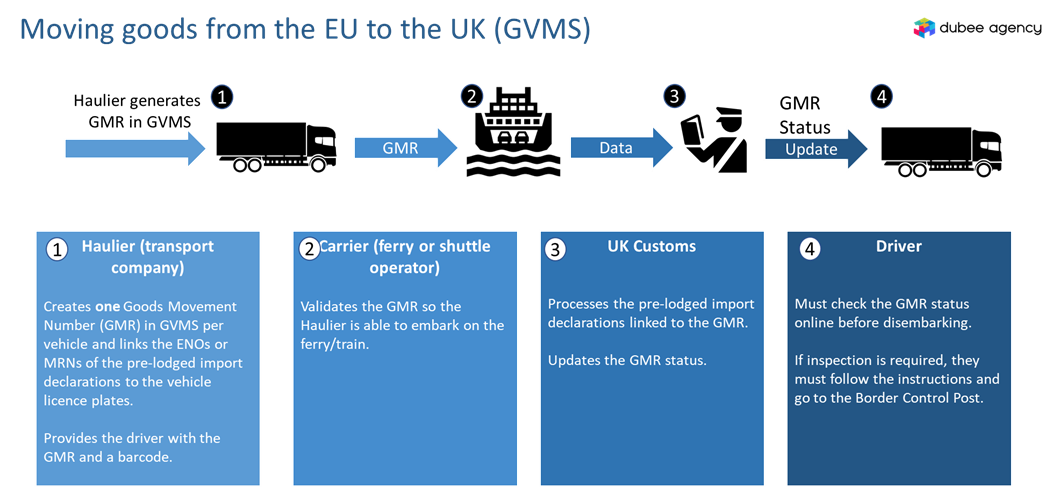

• GVMS is a UK online system for linking UK customs declarations to vehicle licence plate numbers

• The haulier (vehicle operator) is responsible for the GVMS submission

• All goods in a vehicle must be declared to the UK customs system and submitted to GVMS before embarking on a ferry

• Goods Movement Number (GMR) that is generated in GVMS must contain all the declarations’ entry numbers on the truck: import and transit declarations

• If a customs declaration is submitted to the UK customs system, but is not contained in GMR, goods won’t be automatically cleared

Please find the workflow below

If the haulier shows up without a GMR, they won’t be allowed to embark on the ferry.

There is no possibility of goods being declared after they arrive in the UK in a regular procedure.

If all or some of the goods are not declared into the UK customs system, they might be considered as smuggled.

Useful links:

The UK company will not be able to claim preferential rate on those goods and will have to pay import duty at a full duty rate.

Useful links:

Documents: